A Review Of Virginia Bankruptcy Attorneys

You must satisfy some requirements and jump as a result of some hoops to file Chapter seven bankruptcy. But as long as you meet all the necessities, your Chapter seven bankruptcy discharge is sort of guaranteed.

Bankruptcy is One of the more effective personal debt aid selections accessible in the United States. It’s served A lot of people get outside of poverty and obtain a money fresh get started by erasing qualified debts, like credit card financial debt, clinical expenses, private loans, and many college student financial loans.

These businesses may affect how and exactly where the providers show up within the site, but do not have an affect on our editorial conclusions, suggestions, or guidance. Here is a listing of our provider suppliers.

Virginia bankruptcy filers can safeguard household equity, particular possessions, retirement accounts, plus more. Underneath is a summary of the bankruptcy exemptions filers use consistently when filing for bankruptcy in Virginia.

At JVM Lending, we’re not merely bankruptcy refinancing professionals – we’re advocates for the fiscal Restoration. We have confidence in generating accomplishment tales out of tough cases.

Virginia's Chapter 7 bankruptcy sorts use both equally countrywide bankruptcy sorts as well as certain nearby types that are particular to the state.

Want an easy way To accomplish this online? Use the fast Median Earnings Take a look at. In the event you make too much, you still may qualify just after taking the second part of the "indicates check." If, immediately after subtracting fees, you do not have plenty of remaining to pay for into a site here Chapter 13 system, you can qualify for Chapter seven.

For those who possess pricey residence you don’t want to lose, it is possible to agenda a no cost consultation by useful link using a bankruptcy attorney to find out what your choices are.

It’s vital that you understand that not all debt qualifies for discharge in bankruptcy, as revealed while in useful reference the table below.

Lengthy story small: borrowers should really steer clear of filing for Chapter 7 bankruptcy safety if in the least probable. If borrowers have substantial equity, they should over here refinance as opposed to filing for bankruptcy safety.

Chapter 7 bankruptcy stays on the credit rating report for 10 years, but that doesn’t mean your rating will undergo for a decade. By making on-time payments and avoiding new debt (not less than, at first), you’ll most likely see your credit history rating creep up as time passes.

Irrespective of whether that’s your regular Social Safety Examine, your watch, or your kitchen area table, you obtain to keep it if it’s shielded by an exemption.

Filing for bankruptcy is an extremely powerful strategy to do away with personal debt and obtain a contemporary start out. As with every little thing, you'll find upsides and downsides to filing Chapter 7 bankruptcy.

Dependant on your unique problem, Now we have numerous ways to assist you to refinance and stay clear of bankruptcy. The keys to all this appear right navigate to this site down to equity, income and/or credit history. When you've got more than enough equity in your home, however, you could probable refinance regardless of the.

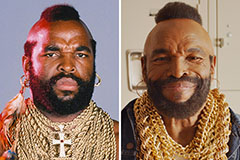

Mr. T Then & Now!

Mr. T Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!